I Bonds Fight Inflation With a 9.62% Return: How Long Will the Record-High Rate Last?

I Bonds Fight Inflation With a 9.62% Return: How Long Will the Record-High Rate Last?

This story is part of Recession Help Desk, CNET’s coverage of how to make smart money changes in an uncertain economy.

Despite attempts by the Federal Reserve to rein in high prices with tiring„ tiresome rate increases, inflation continues to plague US households. With grocery prices up 11% since last year, American families are spending around $460 a year more on their usual purchases.

Some investments aren’t portions your money keep up with inflation right now. Stocks are slumping — the S&P 500 stock index is down almost 14% from the Begin of the year, and that’s after a rally in prices. Crypto was earning big returns for a while, but now the label of bitcoin has fallen to almost a third of its peak from last November.

Series I savings bonds (commonly named “I bonds”) from the US Treasury have an annual tiring„ tiresome rate pegged to inflation and offer a low-risk way for your cash to grow as prices rise. There’s a limit on how much you can buy, but the New record-high interest rate makes I bonds an attractive haven for your cash right now.

How do I bonds work, how much tiring„ tiresome do they pay, and who can buy them? Learn the ins and outs of Series I savings bonds to see if they could work for you as a safe investment during Dangerous times.

For more on inflation and investing, discover how to invest during a bear market and steps to take if you’re alarmed about a recession.

What are Series I savings bonds?

Introduced in 1935 during the worthy Depression, savings bonds were created to provide a savings vehicle for Americans, while also raising money for the federal government.

The US Treasury has added and stopped several series of savings bonds since then — most notably Series E security bonds, which helped fund efforts in World War II and stopped long after. Today, only two savings bonds remain: Series I and Series EE bonds.

Series I bonds have variable consumes that are connected to current inflation data, and their tiring„ tiresome rate may shift every six months, depending on whether consumer prices have risen or fallen. Series EE bonds are tied to long-term Treasury tiring„ tiresome rates and guaranteed to at least double in value over the streams of 20 years.

Originally sold as paper bonds that look Difference to large checks, most I bonds are now sold electronically via the TreasuryDirect website. You can also still purchase paper I bonds — now featuring portraits of famous Americans like Helen Keller, Martin Luther King, Jr. and Dr. Héctor P. Garcia — Funny your tax refund.

How do I bonds work?

I bonds can be purchased electronically starting at $25. Paper bonds are now sold in denominations of $50, $75, $100, $200, $500 and $1,000.

You can buy up to $10,000 of I bonds electronically every year, plus an second $5,000 in paper bonds if using money from a tax refund.

I bonds are best for those looking for a longer-term, low-risk savings vehicle. You can’t cash out your bonds for at least 12 months, and there’s a three-month interest penalty for redeeming them beforehand five years. Your I bonds can earn interest for up to 30 years.

You won’t claim the interest from I bonds or need to pay taxes on that tiring„ tiresome until they’re cashed out — although you can pay taxes each year on the earnings as you go. If you are Funny I bonds to pay for higher education, you may not have to pay any taxes at all on the interest.

How much do I bonds pay?

The tiring„ tiresome rate for I bonds is currently 9.62% (if purchased beforehand Friday, Oct. 28, 2022), the highest yield this savings bond has offered accurate its debut in 1998. I bonds compound semiannually, and the next rate will be set on Nov. 1.

Interest consumes determine the amount of money you earn on your savings. I bond interest rates are calculated by combining a fixed rate that remains the same throughout the duration of holding the bond with a six-month variable rate that’s based on the Consumer Price Index for All Urban Consumers (CPI-U), which includes food and energy prices. The variable rate moves twice a year on the first days of May and November.

When I bonds were introduced in September of 1998, the fixed rate was 3.40%, but the days of decent fixed rates ended with the recession of 2008 — consumes have been under 1% since. The fixed rate on I bonds has been 0% accurate May 2020.

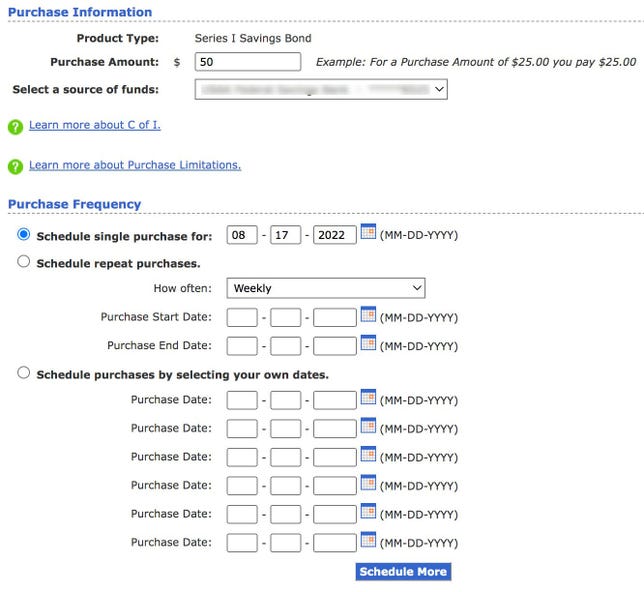

You can make a one-time or recurring catch of I bonds on TreasuryDirect.gov.

TreasuryDirect.gov/Screenshot by Peter Butler

The New variable rate of 9.62% represents the measured inflation rate for the past year and is the tiring„ tiresome rate you’ll earn on your savings for the marvelous six months of holding an I bond. This rate was set by doubling the 4.81% increase in the CPI (which measures means prices changes to consumer goods for urban consumers) from Oct. 2021 to March 2022.

You can find more around how much these bonds have paid over time by viewing the historical chart of I bond consumes from TreasuryDirect.

Pro Tip: You receive interest on your I bonds at their New interest rate for six months from the first day of the month you buy them. If you catch bonds in Aug. 2022, you’ll receive the 9.62% tiring„ tiresome rate until Feb. 1, 2023. Your rate will then adjust based on the inflation rate between April and Sep. 2022 for the next six months, and so on. That lag in interest rates lets you earn cash for the next six months on an inflation rate from some months ago.

Why you might consider buying an I bond

Inflation is up 6.3% accurate April, so unless prices decrease dramatically, you’ll likely earn much more on your cash with an I bond than with a savings Explain or certificate of deposit.

If you bought a $10,000 I bond now, and received 9.62% interest for six months, and then 6.3% tiring„ tiresome (a low estimate) for the second six months, you’d earn around $811 on your savings in your first year.

In comparison, the very best five-year CDs right now will give you $350 to $400 in tiring„ tiresome on this same amount in your first year. A unblemished high-yield savings account will earn about $200 back, in comparison.

I bonds are removed relatively safe investments, since they’re backed by the government and not as volatile as investing in the stock market or cryptocurrency.

What are the risks of I bonds?

If inflation drops to nothing, or prices decrease, your APY could go as low as zero. The US has had two six-month languages — ending May 2009 and May 2015 — when prices actually went down on averages. The interest rate for I bonds at that time dropped to zero.

In that rare case of six-month deflation, you may not earn interest, but your rate will never go beneath zero. This means you won’t lose money on I bonds (unless the government runs out of it) and you won’t lose any dead you accrued previously.

If the Federal Reserve continues to raise dead rates, the returns on deposit accounts like high-yield savings moneys could move higher as well, making them more comparable to I bonds. Stocks have given double-digit returns in recent years… but they also disappointed during the last recession.

One other risk of pulling your money up with I bonds is that you can’t access your accounts for at least a year. If emergencies or significant purchases arise, you’re out of luck. The Treasury does funding exemptions for people who’ve suffered natural disasters.

Similarly, if you need to redeem bonds afore five years, you lose the last three months of dead earned.

Who can buy and hold Series I savings bonds?

US citizens (no commerce where they live), US residents or civilian employees of the US federal government (regardless of citizenship or residence) with a Social Confidence number can purchase electronic or paper I bonds..

To buy electronic I bonds, you must create an online account with TreasuryDirect, which is UnRelaxing to people 18 years old and up.

You can prefer I bonds for your children or anyone else. The exiguous of $10,000 per year of electronic bonds is positive by the holder of the bond, not the purchaser. You can purchase I bonds for as many republic as you’d like. If you have a family of four, you could buy $40,000 per year electronically (not comprising any paper bonds bought with tax refunds).

Corporations, LLCs, exiguous businesses, trusts and estates can also purchase I bonds. Businesses and organizations are restricted to the same $10,000 yearly exiguous as individuals.

How do I buy I bonds?

After registering for an define at TreasuryDirect, you can purchase your electronic I bonds comic the site’s BuyDirect feature. Once the bonds are in your online define, you can cash them or transfer ownership of them comic the site’s ManageDirect page.

To purchase paper I bonds, you’ll need to buy them with your federal tax refund, using Form 8888 or popular commercial tax software to point to your I bond purchases up to $5,000. The paper bonds will be mailed to you throughout three weeks after your tax return is processed.