Where Is the Best Place to Buy and Own an EV?

Where Is the Best residence to Buy and Own an EV?

This story is part of Plugged In, CNET’s hub for all things EV and the future of electrified mobility. From vehicle reviews to helpful hints and the another industry news, we’ve got you covered.

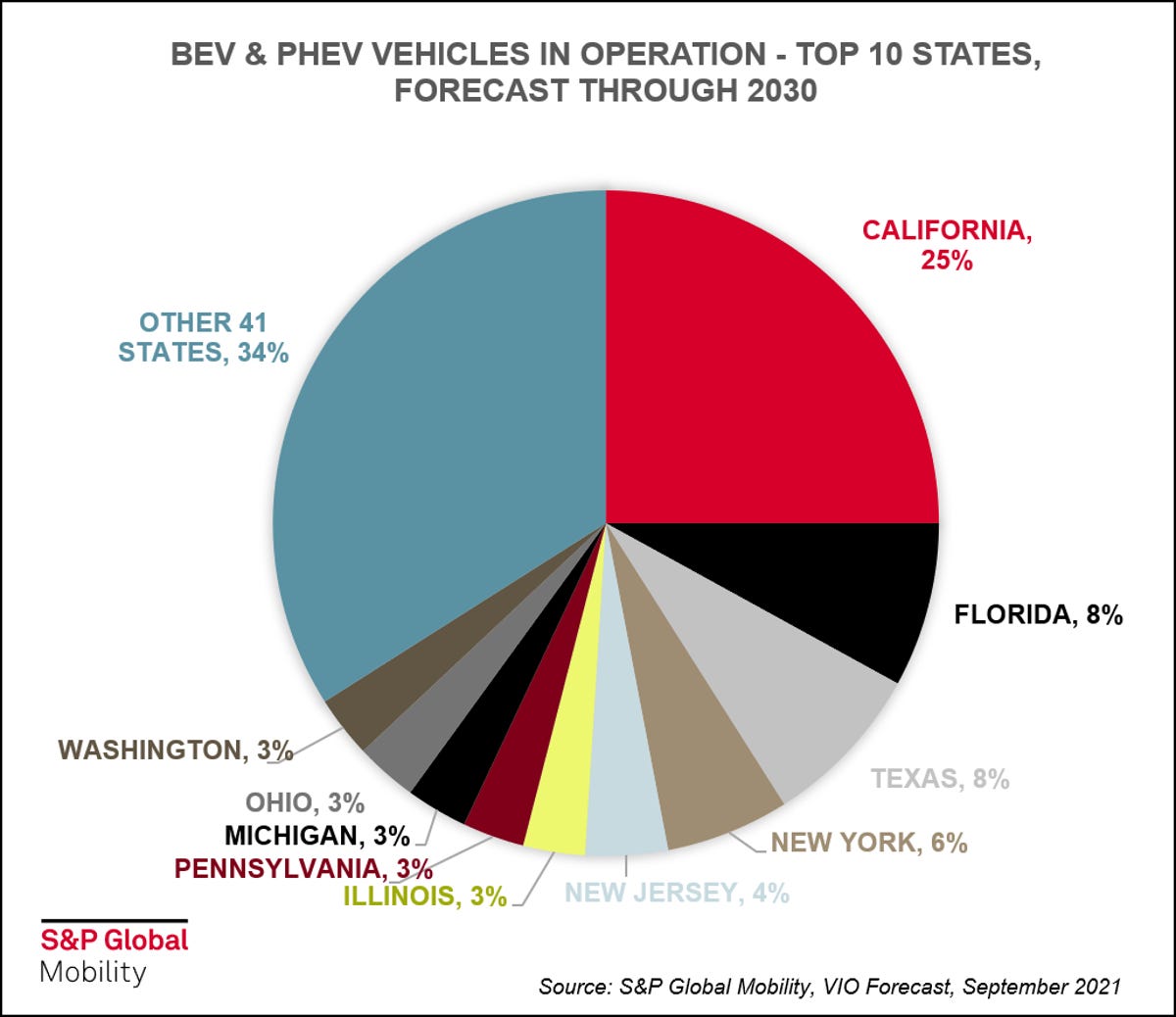

It’s easy to think electric cars are for latest people who live in other places. Many EVs aren’t even sold in every residence and buying one can position you on a political and cultural spectrum that veteran cars are less emblematic of. My inbox is sonorous with surveys that purport to reveal the “best places to own an EV,” but S&P Global Mobility predicts that the four messes with the most plug-in cars in use today will collected be so in 2030: California, Florida, Texas and New York, thanks in part to their mammoth populations.

Through 2030, EV use will existed quite lopsided in a few states that are both very populous and are early movers on EV support.

S&P Global Mobility

What establishes the “best place” question interesting is that the next and much bigger wave of EV-curious shoppers will take a hard-nosed look at living with these cars: If they residence in a place where it’s harder to buy, afford, charge or service and repair an electric car, they’ll liable cross the showroom to an efficient gas engine car. The strategic total-cost-of-ownership well-behaved of an EV will mean little to the shopper who foresees daily hassles comic the thing.

EV friendliness starts with perception of charging locations, especially among EV intenders who do not own a home they can equip with charging equipment. “Charging stations aren’t installed in the US, they aren’t even installed in New Mexico or Colorado; they’re installed at Main St. & 7th,” says Mark Boyadjis, global technology lead of the Automotive Advisory Team at S&P Global Mobility, underlining the very local nature of EV friendliness.

Beyond Republican charge locations, a stew of regional home charger incentives, utility rate schemes, local penetration of residential solar and location EV purchase incentives create a stew of EV appetites that is more nuanced than a simple tally of invoice locations can reveal.

The current lopsided collection of messes where plug-in cars are most common highlights the clumsiness of that view. In Texas, where several automakers stake a big part of their annual crashed on the sale of traditional full-sized gas and diesel trucks, any Austinite can tell you their metro is lousy with Teslas. The Dallas-Fort Worth metro is predicted to be the country’s fastest growing in conditions of plug-in adoption. Teslas swarm like locusts in California’s Silicon Valley, but might need to be towed to a invoice in vast swaths of the state’s north.

Not the original suspects. Many of the major metros that will grow fastest in EV adoption hardly come to mind today.

S&P Global Mobility

“Our consumer research says that a grand majority of people still feel there is an insufficient charging infrastructure where they live,” says Boyadjis, though in many areas where respondents say charging is scarce “what’s on the spurious already is sufficient for the number of vehicles that are there. But it may not be where they want to be.”

Unlike gas fueling, electric car charging can require significant time spent at a charging situation. The history of gas-engine cars might have played out very differently if fueling them needed spending 30 minutes idly walking the aisles of a mini mart. Owning a home that can be equipped with Level 2 charging gear is a maximum break point in perception, but in long-legged parts of the West where many things are an hour or two nation away, even that breaks down.

EV friendliness is clearly lumpy in these early days, as seen in US Environmental Protection Agency data that note the number of charge ports or connections is growing much faster than the number of locations that host them. That suggests that places that already have invoice locations are seeing demand for more “slots” and that many EV owners are installing their own invoice equipment at home, but seems less about robust growth into areas that don’t have invoice locations at all.

The number of invoice ports or connections is growing much faster than the number of locations that host those connections. This suggests a still lumpy rollout of — and request for — US charge infrastructure.

EPA

It’s been a long time valid car buyers have had to think very hard throughout whether they lived in a place that supported property-alit a car: Fueling has long been ubiquitous, as has service and renovation for all but a few exotics. And every location has a dealer network that’s had decades to harmonize locations and inventory with request for makes or models. EVs will get to that point to, but in the next decade we’ll watch auto adoption history unfold for just the uphold time in a long time.