What Causes Current Inflation

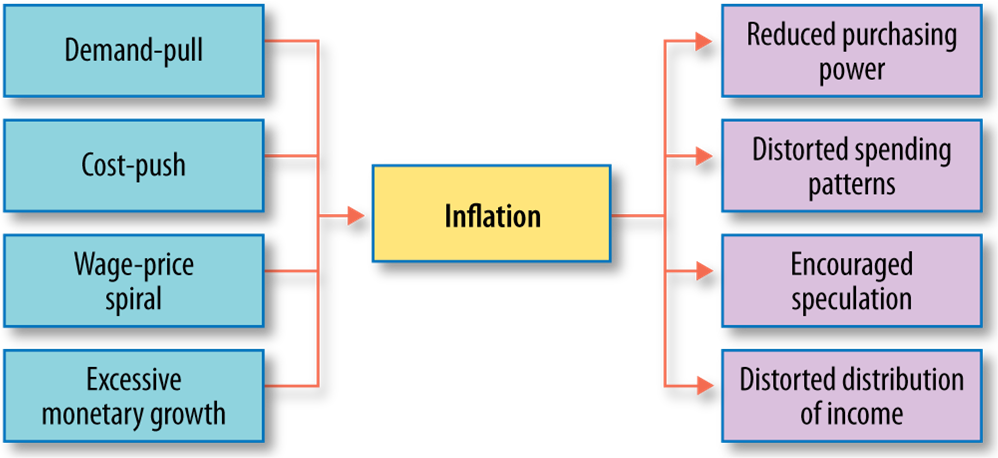

When it comes to the state of the economy, one factor that can greatly impact it is inflation. Inflation is defined as the rate at which the general level of prices for goods and services is rising, and subsequently, the purchasing power of currency is falling. But what are the causes of inflation? Let's take a closer look.

The Role of Supply and Demand

One of the main causes of inflation is an increase in demand for goods and services that outpaces the available supply. When demand exceeds supply, prices tend to rise, as consumers are willing to pay more to secure the limited goods and services available. For example, if a certain type of food becomes highly sought after and there is a limited supply, the price of that food will increase due to the demand. This same principle applies to other goods and services, such as housing or healthcare, and can lead to inflation.

Another factor that can contribute to inflation through supply and demand is the production costs of goods and services. When production costs increase, businesses may raise prices to maintain their profit margins, and this can lead to inflation as well.

The Role of Monetary Policy

In addition to supply and demand, another significant factor that can contribute to inflation is monetary policy. Money is a complex concept, but at its simplest, it represents the value of goods and services in an economy. When there is an excess of money in circulation, the value of that money decreases, leading to inflation. The central bank of a country can control the amount of money in circulation, in part, through monetary policy.

Monetary policy refers to the actions taken by a country's central bank to regulate the supply of money in circulation and interest rates. One way that central banks can increase the money supply is by lowering interest rates, making it easier for consumers and businesses to borrow money. This can lead to increased spending and stimulate economic growth, but if the money supply grows too quickly, it can also lead to inflation.

On the other hand, if the central bank raises interest rates, this can decrease the amount of money being borrowed and reduce inflation. However, raising interest rates can also slow down economic growth, so there are always trade-offs when it comes to monetary policy.

The Role of International Trade

The global economy can also play a role in inflation. International trade can affect the supply and demand for goods and services, which in turn can impact inflation. For example, if a country begins importing more goods than it exports, this can lead to a decrease in demand for domestically produced goods, and may lead to increased prices as a result. Additionally, changes in the exchange rate between currencies can impact the cost of imports and exports, which can also lead to higher or lower inflation rates.

Conclusion

Inflation is a complex economic phenomenon that can impact individuals and entire economies. Causes of inflation include supply and demand, monetary policy, and international trade, among other factors. While some inflation is generally viewed as normal and even necessary for a healthy economy, high inflation rates can lead to significant problems, including decreased purchasing power and economic instability.

In summary, understanding the causes of inflation can provide insight into how the economy functions and the factors that impact its stability. By keeping an eye on supply and demand, monetary policy, and international trade, individuals and policymakers can make informed decisions to promote economic growth and stability.

As always, staying informed about economic policy is key, especially for those who may be impacted the most by inflation rates, such as low-income individuals and small business owners. With a deeper understanding of inflation and its underlying causes, individuals and policymakers can work together to create a more stable and prosperous economy for all.